Its chances of success are still uncertain, but the advent of quantum computing could disrupt many sectors of activity. A prospect that is attracting billions of dollars in investments in the field.

The artificial intelligence (AI) revolution is not even fully consumed yet, and another potential disruption is looming on the horizon, already making investors salivate. As incomprehensible to the average person as AI, quantum computers could become a reality by the end of the decade and bring about no less significant changes.

Wide Angle

This new type of computing relies on the particular characteristics of the infinitely small, which allow particles to be superimposed, that is, in two states at once. By freeing processors from the 1-0 duality, it promises exponentially growing computing capabilities capable of making any classical computer obsolete.

This power would enable the discovery of new materials, perfect optimization of many processes, or even cracking all secret codes. In theory, at least, because in practice, quantum computers do not yet work. However, several advances made in recent years have opened the door to optimism and the billions of dollars that come with it.

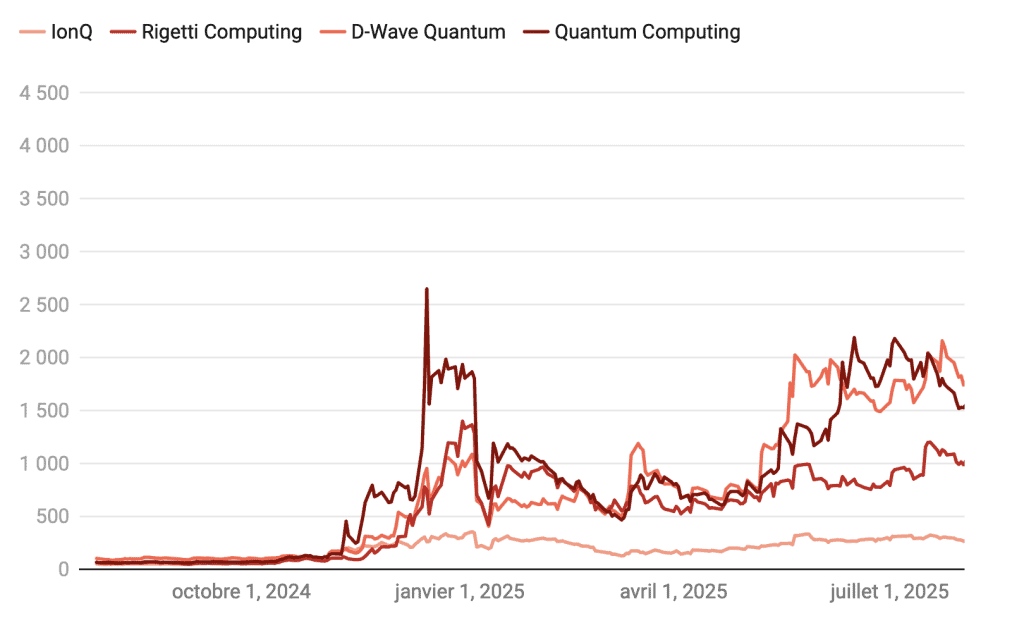

Stock Market Surge

In December 2024, a key announcement from Google unlocked a major barrier. The tech giant announced that it had succeeded in creating the first “logical quantum bit (qubit)”. Behind this arcane jargon may lie the solution to the main problem of quantum computing. These machines are indeed sensitive to variations in their environment. The slightest disturbance, or “noise,” causes errors. Complex technical solutions have been developed to address these weaknesses, but they generally require building a very large number of “classical” qubits to obtain a single effective qubit, called a “logical qubit.” By succeeding in obtaining one, Google established a proof of concept.

In response, the stocks of the few quantum computing companies listed on Wall Street soared, and the trend continues to this day. Since the end of 2024, IonQ has seen its stock triple, and D-Wave Quantum’s has gone from $5 to $40.

The effect has also spread to the unlisted world. Several startups in the sector have raised tens or even hundreds of millions of euros. In France, Alice & Bob raised 100 million euros in early 2025. The Finnish company IQM raised 320 million dollars in September through a funding round led by the U.S. fund specialized in cybersecurity, Ten Eleven Ventures.

At the same time, the Californian PsiQuantum raised 1 billion dollars in an operation led by BlackRock, Temasek, and Baillie Gifford. On September 4, Quantinuum also announced it had raised 600 million dollars through a funding round organized by its main shareholder, the industrial giant Honeywell. In February, QuEra had also secured funding of 230 million dollars, and the Israeli Quantum Machines, a supplier in the sector, had raised 170 million dollars.

Signs of a Quantum Bubble

Investors with Varied Profiles

These operations have been supported by several funds specialized in new technologies, such as Valor Equity Partners, SoftBank, Serendipity Capital, or Type One Ventures, but also more traditional asset managers like BlackRock or T. Rowe Price, banks, or even the sovereign funds of Qatar and Singapore. Tech giants are also present, foremost among them Nvidia, which participated in recent U.S. funding rounds, but also Google, Samsung, or Qualcomm.

In France, the Supernova Invest fund, created by CEA and Crédit Agricole in 2017, participated in the funding rounds of Quobly and Alice & Bob. Specialized in the theme, Quantonation is present in the capital of most French players. Large companies like Aramco, CMA CGM, and Eni have also invested in Pasqal.

The public sector is also heavily involved, whether through Bpifrance or the European Innovation Council. In 2024, public funds even represented 34% of global investments in quantum technologies, compared to 10-20% in the previous three years, according to a McKinsey study.

This influx of fresh money first illustrates the confidence of all these startups in their ability to build a working quantum computer in the coming years. Most aim for a first machine with 100 logical qubits by the end of the decade. At this level of power, “a quantum computer becomes capable of solving problems that no other technology, neither classical computing nor artificial intelligence, can address,” says Maud Vinet, CEO and co-founder of Quobly. It is also the threshold at which quantum computing begins “to present real industrial interests in materials science and chemistry,” adds Jean-François Bobier, partner and vice-president Deep Tech at Boston Consulting Group.

An Impact of 2,000 Billion Dollars?

According to him, the quantum computer market should thus begin to ramp up gradually from 2030, going from less than 2 billion dollars annually in the 2020s to 15-30 billion dollars in the following decade. More optimistic, McKinsey targets a market between 16 and 37 billion dollars in 2030, then 45-131 billion dollars ten years later. Analysts at Bank of America anticipate a pie of 4 billion dollars in five years.

The overall economic impact of quantum computers could be between 900 and 2,000 billion dollars as early as 2035 according to McKinsey, with particularly marked effects for the chemistry, life sciences, finance, and mobility sectors. Boston Consulting Group estimates it between 450 and 850 billion dollars after 2040. “We consider that the industrialization of quantum computing will be more complicated than expected: the supply chain could be complex to set up with possible supply constraints, particularly on helium which is used to cool the machines, but also in labor because assembling computers requires highly qualified profiles,” indicates Jean-François Bobier.

A Non-Negligible Risk of Failure

Whatever forecasts are retained, the computer market could reach a significant size in less than ten years. Enough to justify investor interest but probably not the valuation levels reached by some companies. In the United States, IonQ’s market capitalization is 20 billion dollars, Rigetti Computing’s is close to 15 billion, and it exceeds 12 billion for D-Wave Quantum. In their latest funding rounds, Quantinuum and PsiQuantum were valued at 10 and 7 billion dollars, respectively. Collectively, these five startups, which generate no more than a few tens of millions in revenue per year, are thus valued at around 64 billion dollars. That’s 2 to 16 times more than the estimated size of their market in five years.

A level that seems all the more surprising since it is not yet certain that a single quantum computer will ever work. Although recent advances are encouraging, the scientific community still appears divided on the subject. In an interview given in June to “Pour la Science,” physicist Jean Dalibard estimated “that we might celebrate the first real quantum computer, capable of universal calculations, in ten years.” Two years earlier, the famous science popularizer Julien Bobroff said in a conference that some physicists had confided to him that they did not believe in quantum computers while thinking that since “there is money, we go for it, anyway we’ll do interesting things along the way.”

Xavier Waintal, research director at CEA and director of Maison du Quantique Alpes, is one of these skeptics. Interviewed by L’Agefi, he believes “that the developments currently taking place in laboratories are magnificent scientific experiments but they are very, very far from being transformed into real quantum computers.”

“I don’t think I’ll see it happen in my lifetime and, even if I were wrong, it’s not clear that these computers will lead to truly useful practical applications,” adds the researcher, who even imagines that the true quantum computer will simply never see the light of day.

Different Technologies

Faced with these doubts, all startup leaders specialized in quantum display, on the contrary, their confidence. “Every day that passes, the probabilities that the useful and error-tolerant quantum computer will never see the light of day decrease,” says Valérian Giesz, chief operating officer and co-founder of Quandela. However, it remains to be seen which technology will prevail. To create a superpowered machine, not all companies take the same path. There are four main types of technology.

Many Sectors Would Be Affected by Quantum Computers

The most mature is the so-called superconducting technology, developed notably by IBM, Google, D-Wave, Rigetti, or Alice & Bob. It relies in particular on the research of the last Nobel Prize in Physics trio and “has the advantage of being very fast with around a million calculations per second but is penalized by low connectivity and fidelity,” explains Jean-François Bobier. Conversely, the “neutral atom” or “trapped ion” technologies, deployed by Pasqal in France or IonQ, Infleqtion, Quantinuum, and QuEra in the United States, “are more reliable, because the qubit is a natural atom that does not need to be manufactured, but much slower,” estimates the BCG specialist.

Companies like Quantum Computing, PsiQuantum, or the French Quandela use photons as qubits with encouraging results, but doubts remain about their ability to scale “because the loss rate is high, which requires a large number of photons,” specifies Jean-François Bobier. Finally, the so-called “spin qubits” technology deployed by Intel or the French Quobly and C12 relies on semiconductors. It is considered promising but at an earlier stage of development.

Winner Takes All?

All the specialists interviewed acknowledge that it is impossible today to say which of these technologies will prevail. “The latest large funding rounds suggest that investors are currently convinced by photonics and trapped ions, with the massive funding rounds of PsiQuantum and IonQ, but the road is still long and this probably does not predict the final finish line,” notes Damien Bretegnier, investment director in digital technologies at Supernova Invest. Another expert would see superconductors leading the race before possibly being overtaken by spin qubit technology which, if it delivers on its promises, would have the advantage of scaling quickly.

Most of our interlocutors do not rule out that two or three technologies could coexist, at least temporarily. “One type of quantum computer could, for example, be particularly effective at solving optimization problems while another would be better at simulating reality,” imagines Damien Bretegnier while specifying that the associated end markets will not necessarily be the same size. “For example, the machine that can feed AI with new data will open up a huge market while other outlets will be more limited,” he estimates. Conversely, Théau Peronnin, CEO and co-founder of Alice & Bob, predicts that there will be only one winner in this nascent battle. “In the world of computing, it’s always a monopoly or quasi-monopoly that wins, as was the case with Intel, Arm, Nvidia,” he recalls.

All these uncertainties do not prevent many actors from already taking a close interest in the subject. Groups like EDF, BMW, Crédit Agricole, HSBC, CMA CGM have formed partnerships with startups in the field. Some of them are already drawing revenues from support agreements and consulting missions entered into with companies or public entities (universities, army…). For Damien Bretegnier, this attraction is more of a defensive position than a real enthusiasm for the technology: “large industrials are afraid of missing the boat and being swept away by a competitor who would acquire significant advantages thanks to quantum.”

In hoping that, by then, they will have already succeeded in integrating the artificial intelligence revolution well, whose potential could well be multiplied by the advent of qubit computing.