Leader and pioneer in DeepTech investment

From inception to maturity.

Supernova Invest’s founding team has more than 20 years of experience in deeptech venture capital. The company emerged in 2017 from the alliance between Amundi (Crédit Agricole Group) and the CEA, a key player in technological research.

Supernova Invest is an independent management company, investing mainly across Europe. Investment decisions are made by the partners on the Investment Committee.

With a total of about 100 investments and more than 70 portfolio companies, Supernova Invest benefits from a unique track record in deeptech, as reflected in its 30+ successful trade exits.

The Supernova Invest team combines the best of technology and financing. What sets us apart is our ability to understand both the underlying technologies and the most complex deep tech business models.

m€ AUM

Offices

Companies Backed

Years

Our sectors

INDUSTRY 4.0

Engineering tools

Production tools

Embedded systems

Logistics

HEALTHCARE

Medtech

Biotech

Diagnostics

Discovery Tools

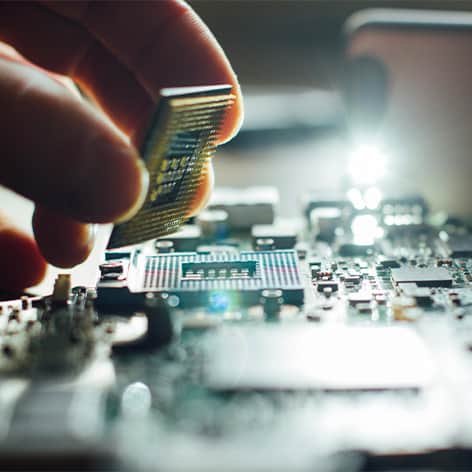

DIGITAL TECHNOLOGIES

Computing

Semiconductors

Cybersecurity

Telecom

ENERGY & ENVIRONMENT

Cleantech

Energy Transition

Agritech

Foodtech

Our partners

LP and co-investor

Shareholder, LP and co-investor

Shareholder, research partner, LP and co-investor

Investor and industrial partner

Investor and industrial partner

Investor and industrial partner

Investor and industrial partner

Investor and industrial partner

Our operating partners platform

Supernova Invest collaborates with a selection of Operating Partners in order to industrialize our value-add support to our portfolio startups and facilitate the adoption of deeptech best practices. This program is an illustration of the Supernova Invest platform for Entrepreneurs, dedicated to the deeptech-specific challenges that they experience in scaling their startups. In the ever-growing landscape of deeptech funds, these operating partners incarnate our investor singularity as the pioneer and deep-tech leading VC firm. They were carefully selected, leveraging our unique understanding of deeptech-specific challenges and our join track record in getting deeptech startup to thrive. They embrace a one-of-kind, extensive scope of critical expertise to provide our entrepreneurs with the most elaborated deeptech support platform. The selection is the spearhead of a much wider network for fine-grained, custom-made support.

Florence Didier-Noaro

ESG & Impact

Mathieu Porchet

IP management & technology transfer

Arnaud Dupui-Castérès

Strategic communication, influence and risk management

Takfarinas Chabane

Strategy, stakeholders relations & governance

Jacques-François Fournols

Executive coaching & impactful organizations

Frédéric Cherpentier

Outsourced production strategy

I benefited from an individual coaching with Jacques-François. The coaching framework (confidentiality, caring, impartiality) allowed me to take a deep dive in my methods and my ecosystem. Working sessions are set up around concrete case studies, with the support of strategic tools, providing a better understanding of interactions. We gain impact!

In our quest to develop and launch the next revolution of quantum computers , Alice & Bob is firmly positioned at the forefront of technological breakthroughs. By collaborating closely with Mathieu, we are implementing a strategic intellectual property strategy that strengthens our ecosystem of partners and guarantees our leadership in the field. Mathieu has unrivalled experience with academic research institutes and a fine-grained understanding of the challenges we are facing as a deeptech startup.

Florence transformed an ESG due diligence into a true exploration of our risks and opportunities related to sustainability issues. We were able to reliably assess our environmental and social contribution, and we are building a roadmap that sets our course and allows us to foster a constructive dialogue with all our stakeholders. Thanks to Florence, ESG is no longer a simple formal reporting but a true value creation process.